what is the sales tax rate in tampa florida

The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. 31 rows The state sales tax rate in Florida is 6000.

Florida S State And Local Taxes Rank 48th For Fairness

While Florida has a sales tax of 6 the actual sales tax for a vehicle in this state depends on the exact city you are in.

. Contact 306 East Jackson Street Tampa Florida 33602 813 274-8211. The base state sales tax rate in Florida is 6. Business LicenseTax Renewal Payments Business Tax Record Inquiries Federal Taxes Internal Revenue Service Property Tax Payments Hillsborough County Property Tax.

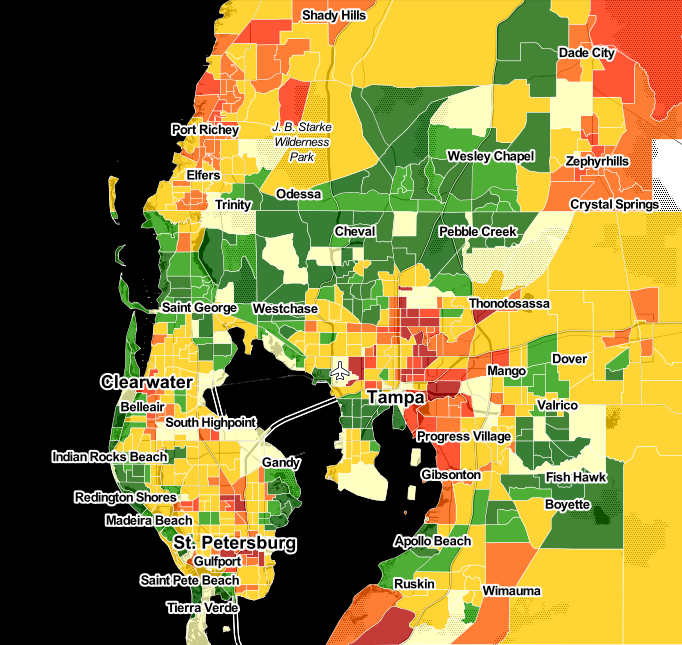

Local tax rates in Florida range from 0 to 2 making the sales tax range in Florida 6 to 8. This includes the rates on the state county city and special levels. Find your Florida combined state and local tax.

Tampa collects the maximum legal local sales tax. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida sales tax details.

Tampa is located within Hillsborough County. Effective March 16 2021 businesses in Hillsborough County Florida are required to adjust the sales tax rate charged on. There is no applicable city.

Floridas general state sales tax rate is 6 with the following exceptions. Dealers should collect only the combined 75 rate. Floridas general state sales tax rate is 6 with the following exceptions.

Groceries and prescription drugs are exempt from the Florida sales tax. This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction.

The Florida FL state sales tax rate is currently 6. That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15. Effective immediately the combined state and local sales and use tax rate for Hillsborough County is 75.

This rate includes any state county city and local sales taxes. Florida collects no income tax and its state sales tax of 6 is significantly lower than any other no-income-tax state. We found that Tampas effective real estate taxes that is tax rates as a.

The tax landscape has changed in the Tampa area. Average Sales Tax With Local. What is the sales tax rate in Hillsborough County.

Groceries and prescription drugs are exempt from the Florida. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. The Hillsborough county and Tampa sales tax rate is 75.

With local taxes the total. In the state of Florida all. The 75 sales tax rate in Tampa consists of 6 Florida state sales tax and 15 Hillsborough County sales tax.

The latest sales tax rate for Tampa FL. The tax landscape has changed in the Tampa area. Local governments can collect up to 15 additional sales.

The average cumulative sales tax rate in Tampa Florida is 75. The minimum combined 2022 sales tax rate for Hillsborough County Florida is. Effective March 16 2021 businesses in Hillsborough County Florida are required to adjust the sales tax rate charged on.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. 732 rows Florida Sales Tax6. Depending on city county and local tax jurisdictions the total rate can be as high as 8.

The Florida sales tax rate is currently.

Historical Florida Tax Policy Information Ballotpedia

Florida Sales Tax Rates By City County 2022

Judge Rules Penny Sales Tax Invalidated By Florida Supreme Court Must Be Used On Hillsborough Transportation

Florida Sales Tax Exemption Opportunities Agile Consulting Group

Florida Vehicle Sales Tax Fees Calculator

Hillsborough County Florida Wikipedia

What Services Are Subject To Sales Tax In Florida

What Is Exempt From Sales Tax In Florida

Sales Tax In Hillsborough County To Increase Jan 1

Florida Sales Tax Rate On Commercial Rent 2020

The Tampa Real Estate Market Stats And Trends For 2022

Hillsborough County Florida Sales Tax Rate 2022 Avalara

The Villages Fl Cost Of Living How Much Does It Cost To Live In The Villages In Florida Data Tips

Overcharged Some Hillsborough Businesses Slow To Lower Sales Tax Rate

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Are There Any States With No Property Tax In 2022 Free Investor Guide

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Florida Retailers Plead For Sales Tax Collections On E Commerce